Those earning up to R$2,640 will be exempt from IR this year, says Revenue – News

2 min read

Employees, self-employed, retirees, retirees and other individuals earning up to a minimum wage (2640 R$) will not be taxed before Income tax already this year.

The federal government announced that The minimum wage will increase from R$1,302 to R$1,320. From the first of May. In addition, it also announced an exemption of up to two floors.

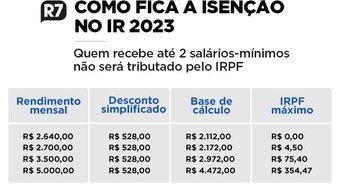

For this, Federal Revenue states that the scope of the exemption o IRPF (Individual Income Tax) It will be increased to R$2,112.00, allowing for a simplified monthly discount of R$528.00.

“Despite all budget constraints and efforts to restore public accounts, the government will serve the population who earn up to a minimum wage, already at the new amount announced by the President, that is, those who earn up to R$ 2,640.00,” the Federal Revenue Service reported in note.

The last update of the income tax schedule was in 2015, 8 years ago, when the exemption range was set at R$1,903.98. Since then, the inflation rate has been around 50%.

“This activation helps Brazilian men and women feel the benefit immediately in their pockets. There will be no tax withheld for this income range. That is, they will not have to wait for the announcement the following year to request a refund of what was withheld,” the recipe explains.

This means that a person earning up to R$2,640.00 will not pay any income tax – neither at source nor in the annual adjustment declaration – and anyone earning above that will pay on the excess amount.

The deduction of R$ 528.00 is optional, that is, those who are entitled to greater deductions under the current legislation (pension, dependents, alimony) will not be harmed.

Revenue adopted expanding the exemption to R$2,112.00 + a simplified deduction of R$528.00). According to the tax authorities, this serves those who earn up to a minimum wage (has the same effect as an increase in the exemption range to R$2,640.00 for these taxpayers), without significantly reducing taxes for higher income groups (for those earning R$10,000). , for example, will not be worth the simplified discount of R$528.00, since your current discounts are higher.

“Entrepreneur. Music enthusiast. Lifelong communicator. General coffee aficionado. Internet scholar.”