Health plans posted their highest operating loss since 2001

2 min read

The companies incurred losses of R$11.5 billion in 2022, but the financial gains from the investments ensured a net profit of R$2.5 million.

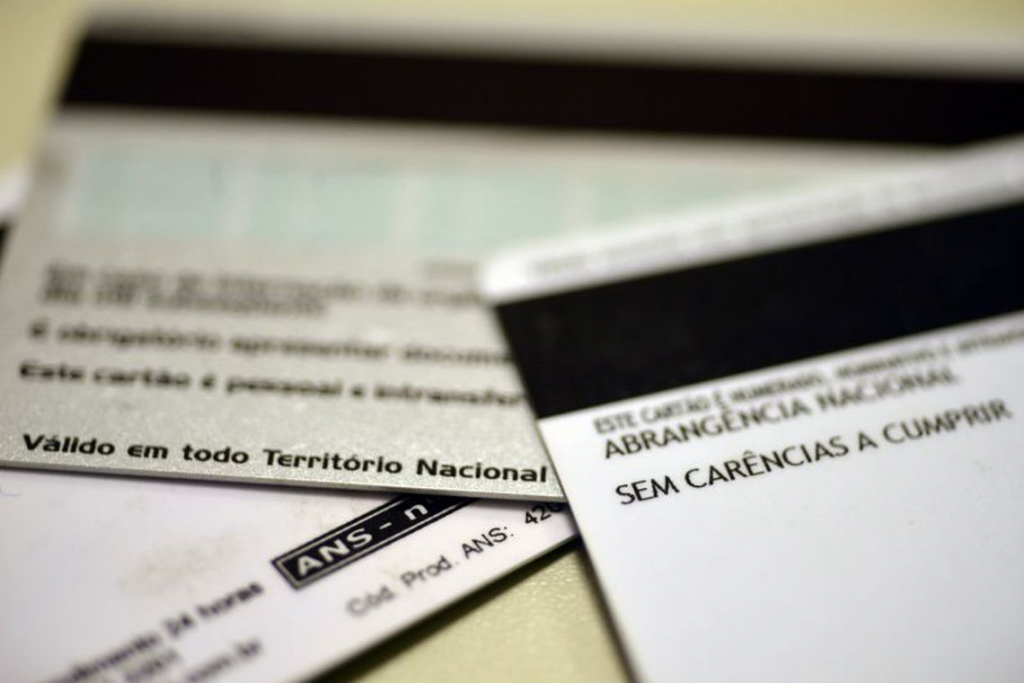

You health insurance It posted an operating loss of R$11.5 billion in 2022, the worst in the historical series that began in 2001. Market estimates had the biggest gap, at around R$15 billion. Despite the loss, the financial gain of R$9.4 billion resulting from the increased interest, received by the operators on the investments, ensured a net profit of R$2.5 million. to National complementary health agency (ANS), the sector balance was “zero to zero”. The table represents 0.001% of the health operations revenues in the sector last year, amounting to R$237.6 billion. The amount is almost irrelevant to the size of the market. 43% of medical hospital operators closed the year with a loss. But in 2020, the region posted record profits of R$18.7 billion, and in 2021, the income generated was R$3.8 billion. For ANS, despite continued growth in the client base since the start of the Covid-19 pandemic, as beneficiaries of medical hospital plans jumped from 47 million in December 2019 to 50.4 million in 2022. In arrangement losses, it was a negative factor. 1.6 billion reais, ranking first in terms of losses. In second place in the hall of those who have suffered the greatest losses is senior ban, in the amount of R$ 872 million; It is followed by Metlife, with a value of R$626 million. Rio Unimed, which had accumulated a loss of R$1.3 billion as of the third quarter, does not appear in this group because it did not provide data for the fourth quarter.

The results are getting worse. Monthly fee revenues seem to be stagnant, especially at the big operators. Assistance expenses and increase in accident rate also contribute to the scenario. The President of the Alliance for the Health of the Population, Claudio Tavla, points out that it is necessary to strive for balance in this market. “Companies, which are now responsible for nearly 80% of health plans, also have the effect of rising costs within this relationship between providers and operators of health plans. The Asap, through the Population Health Administration certification and Health Forum, that discussed formats to offer other options and other forms of Relationships that escape zero sum, i.e. one side’s win needs to be lost and vice versa.”.

*With information from reporter Daniel Lien

“Entrepreneur. Music enthusiast. Lifelong communicator. General coffee aficionado. Internet scholar.”

:strip_icc()/s04.video.glbimg.com/x720/11792055.jpg)

:strip_icc()/s03.video.glbimg.com/x720/11786998.jpg)