A blacksmith strikes a gavel and decides whether to tax Shein, Shopee, and AliExpress

5 min read

to online shopping It is becoming an option increasingly used by consumers all over the world, especially in recent years when technology has become more accessible to a large number of people. This year, one Bad News For that audience who buys into it Internet: The government will conduct greater inspections and tax those who buy abroad.

In Brazil, it’s no different: hAt present, online purchases account for more than 10% of the entire segment national retail. International purchases account for more than double that. in 2022, 72% of consumers have made purchases on e-commerce websites international, such as Shein, Shopee, and AliExpress.

For Brazilians, buying from foreign companies without leaving home is more than just a convenience: the prices are more attractive tooAt least for International orders up to $50 USD (about R$250). On top of that, they may be taxed.

In 2023, Finance Minister Fernando Haddad announced Collection of import tax on purchases of up to USD 50 via online sales platforms from abroad.

that way, Individual purchases made abroad can increase the value of up to 60%as we will explain later.

However, the ad sparked controversy and sparked negative comments on social networks Federal government Reversing the decision while maintaining the tax exemption.

Shein assumes the obligation of nationalization

Fernando Haddad received on April 20, in São Paulo, a letter with commitments from the company it is inin which it undertakes – within four years – to nationalize 85% of sales in Brazil with products made in the country.

“It is very important for us that they see Brazil not just as a consumer market, but as a production economy,” he said. announce.

Another commitment signed, according to the minister, is the company’s commitment to the federal revenue compliance plan. He said that other platforms like Shopee and AliExpresshas already expressed interest in joining the Compliance Plan.

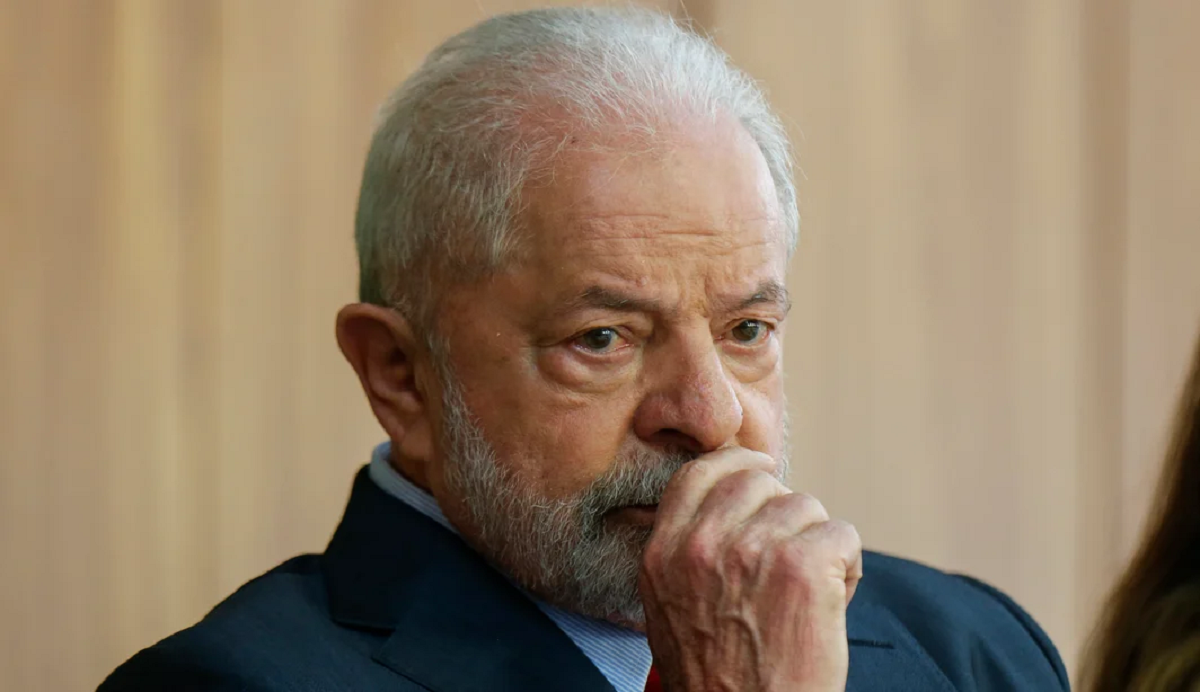

Bad news for Brazilians who shop online. Photo: Sergio Lima/AFP

Nationalization of Shein products: what does it mean?

Nationalization of goods means that these products will be manufactured or produced within the country, rather than being imported from other countries.

In the specific case of Brazil, what does this mean?

Watch some of the consequences that can occur when nationalizing imported goods:

- Domestic firms will start producing the same products that are currently being imported, which may lead to a decrease in imports and an increase in domestic production;

- an increase in the price of imported products;

- Less variety of products available, because nationalization can lead to fewer choices of imported products;

- Job creation and long-term economic growth.

To Tax or Not to Import: What is the Impact?

Regarding the possibility of losing expected revenues for imposing taxes on companies of this kind, Haddad said that “The impact is small even compared to tax reform being implemented to charge those who don’t pay.”

President Lula indicated that he would like to reach an administrative solution to be negotiated with the e-commerce itself. To avoid any kind of trouble, we will follow the example of developed countries, which they call digital abroad. taxdigital tax. That is, when the consumer buys, he is exempted from any tax payments, the tax will have been paid by the company without charging the consumer any additional cost”He pointed to the portal of the Câmara de Notícias agency.

The Finance Minister also stated that this negotiated exit is considering what the Brazilian trade networks were asking for. “It is not right for anyone with an investment in Brazil to suffer unfair competition from anyone,” opened.

“Competition is good only when everyone is on an equal footing, then whoever has the best product and the best price wins. We want to preserve the consumer’s right to access consumer goods, ” announce.

What is import tax?

Import taxes are carried out by the Federal Revenue Service based on the simplified tax system (RTS) and regulated by Order No. 156/1999 issued by the Ministry of Finance. This type of tax is charged upon receipt of the goods in Brazil and is checked at the distribution center that receives the product.

For this, a single rate of 60% of the customs value is applied, which includes the price of the product, freight charges or insurance. any, Import tax corresponds to an additional amount feeplus the amount actually paid for the product and any fees.

Taxation of international purchases has already been discussed since the government of Jair Bolsonaro (PL). At that time, a group of businessmen gathered to discuss the topic.

Lula’s government continued debate at the beginning of his term. The FPE (Parliamentary Entrepreneurship Front), made up of deputies and senators, claims that the competition between companies from Brazil and China is unfair, as Brazilian companies pay a lot of taxes on production, assembly and operations.

In this way, a file is created PL 718/22who argues that the measure aims to prevent companies from importing products on behalf of individuals, to take advantage of the tax exemption.

“Companies with physical stores collect taxes according to the law, while some digital platforms use legal permission to sell their products without properly paying taxes,” Alexandre Frota, PL rapporteur, notes for Agência Câmara de Notícias.

However, the federal government backtracked and abandoned implementing the change, and the Ministry of Finance is studying other ways to increase revenues.

Arguments for and against import taxes

Opinions differed on the idea of collecting customs duties on imported goods. Those who advocate this measure argue that It can encourage the growth of the national marketwhile opponents believe it will be unpopular, as consumers may have to pay more for the products they seek to purchase at reasonable prices.

That is, while some defend that the tightening of measures on imported products benefits the national industry and, in the long run, prevents job losses in Brazil, others assert that with taxes, the government ignores that the consumer is only looking for the cheapest way to buy.

“Entrepreneur. Music enthusiast. Lifelong communicator. General coffee aficionado. Internet scholar.”