After the crisis, the price of KitKat was enough to buy four shares of Americana

3 min read

Posted on 1/19/2023 9:07 PM / Updated on 1/19/2023 9:12 PM

(Credit: AFP – AFP / FABRICE COFFRINI)

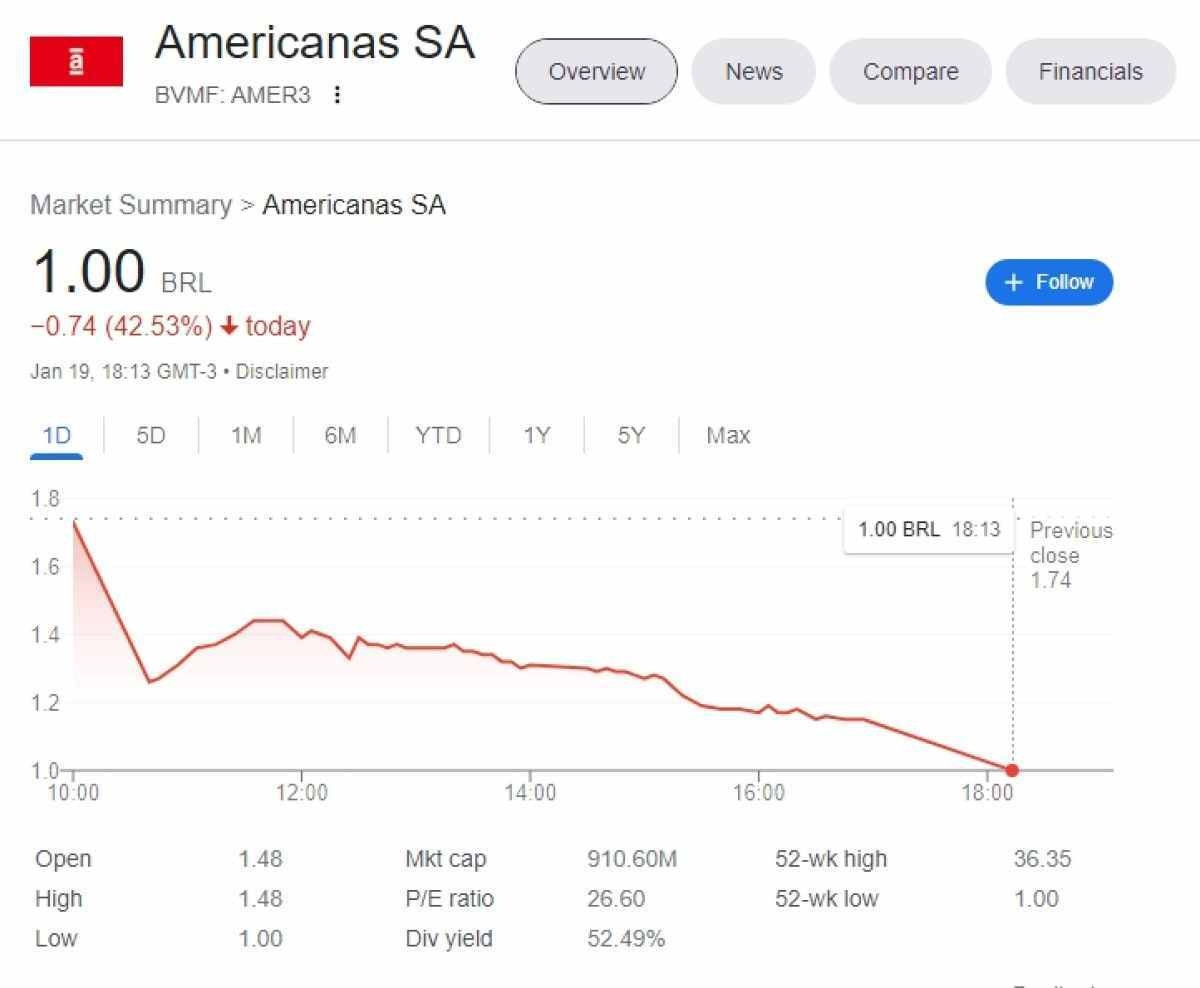

shares Amer 3, American Stores, closed on Thursday (19/1), at a cost of R$1 in B3. For the purpose of comparing the company’s current devaluation, the stake in the company is worth four times less than the unit price of KitKat chocolate, a brand that has become a symbol for Americanas for being offered below market. The company franchises across the country.

On the Americanas website, the Kit Kat costs R$3.99. Chocolate has become, this Thursday (19/1), four times more valuable than the share of the company, which today is experiencing one of the largest commercial failures in the history of the Brazilian market.

The devaluation of Lojas Americanas began on January 11, when the company’s then president Sergio Real – who had been in office for 10 days – resigned after discovering “inconsistencies in accounting entries” worth R$20 billion. The amount, which refers to the first nine months of 2022 and prior years, is not properly recorded on the company’s balance sheets.

(Image: B3/Playback)

“The accounting field revealed the existence of purchase financing operations with amounts of the same order (20 billion Brazilian reais), in which the company is indebted to financial institutions and is not sufficiently reflected in the supplier’s account in the financial statements,” reads the company’s statement after the departure of Sergio Real.

The value of the pit, on Wednesday (1/12), was about what Magazine Luiza was worth in the market – the Luiza Trajano brand was quoted in that day’s trading session for R$20.20 billion. Since then, B3, the São Paulo Stock Exchange, has recorded a drop in the brand’s value, and other major financial institutions have put the company’s shares under review.

Americana’s debt on Thursday (19/1) amounted to R$43 billion and includes financial creditors, workers and suppliers.

The Rio Court accepted the company’s request for injunctive relief

On Thursday (19/1), Americana sent a request for injunctive relief to the Court of Justice of Rio de Janeiro (TJRJ). The company stated that it is unable to move a “significant portion” of the R$800 million in cash, due to a court decision of BTG Pactual (BPAC11) blocking R$1.2 billion from the retailer.

The bank is one of Americana’s most abused creditors. In requesting a refund, the debtor company asks for fairness to cancel the blockade and to involve the bank in the recovery process.

The application was accepted by Judge Paulo Acid, of the Fourth Corporate Court of Rio de Janeiro. He claims the recovery is “one of the largest and most significant filings to date in the country, not only because of its commitments, but because of all the ramifications in the market.” However, the judge demanded that the company provide, within 48 hours, a detailed list of debts to more than 16,000 creditors.

Next, you will enter Americana judicial recovery process – The legal status of a business where debt, interest and other collections are on hold for about 60 days in order to develop a restructuring plan to deal with the debt. Brand will also be given another 120 days to call a meeting with creditors to approve the plan.

If the plan is approved, the request for immediate payment to creditors will be deferred or suspended, so that the company can focus on paying employees, taxes and goods that allow the business to operate. Interest is also suspended during this period.

Correio Braziliense coverage

Do you want to stay informed of the most important news from Brazil and the world? follow him Brazilian Post on social networks. We are involved TwitterIn the FacebookIn the InstagramIn the Tik Tok no Youtube. Continued!

“Entrepreneur. Music enthusiast. Lifelong communicator. General coffee aficionado. Internet scholar.”