After the first semester, what can stimulate the Brazilian stock market? Powered by Investing.com

6 min read

© Reuters

Investing.com – With inflation slowing, prospects for the start of an easing monetary cycle, the outlook solidifying and progress on economic agendas such as the fiscal framework and tax reform, sentiment for the Brazilian stock exchange was positive in the first half, and it ended the period with an increase of 7.61%. For the next six months, taking into account the downward trend, the forecast is more optimistic, according to the specialists he consulted. Investing.com Brazil.

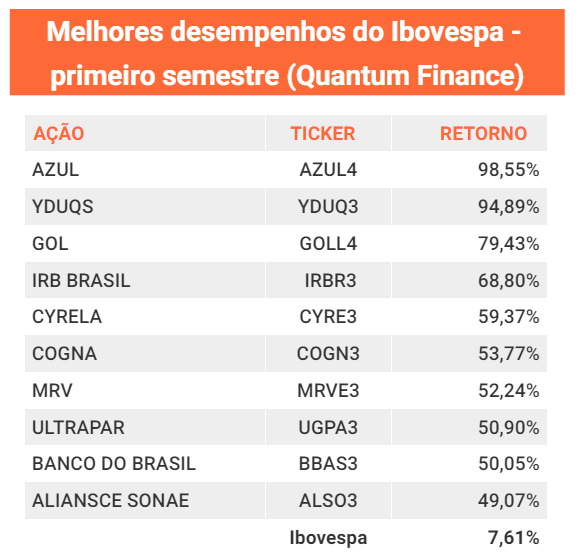

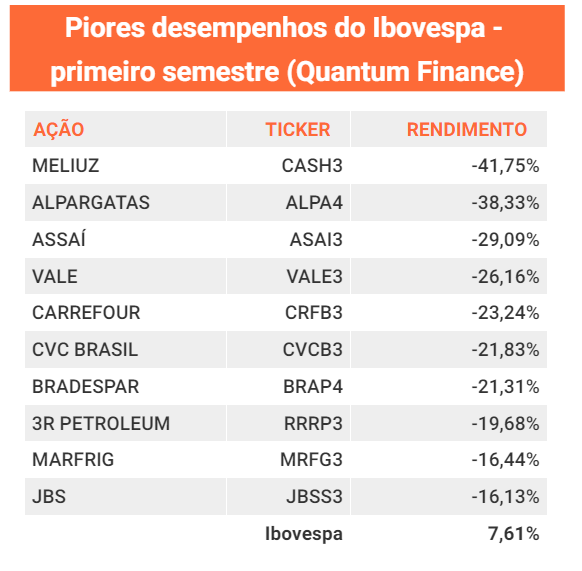

Of the 86 stocks that make up the index, 72% rose in the January-June period, or 64 stocks, according to a survey by Quantum Finance. The best performances were from Azul (BVMF:), Yduqs (BVMF:) and Gol (BVMF:), while the worst performances were from Méliuz (BVMF:), Alpargatas (BVMF:) and Assaí (BVMF:).

Check out the best and the worst:

Source: Quantum Finance

Ibovespa and external scenario

Although the Brazilian stock market rose during the quarter, the Ibovespa index was well below the US indices. The moment in the United States is the moment of recovery. It is down 20% and down more than 33% last year as investors eye a potential recession. Wall Street’s three major indices ended 2022 with the largest annual losses since the 2008 financial crisis. Risk aversion polluted markets during the banking crisis. However, with the help of financial institutions, avoidance of system infection, and pause in US interest rate increases, investors now have a greater appetite for risk. Now, US indices lead the rankings for the semester.

Here, in addition to putting pressure on the market after the discovery of the American Accounting Crisis (BVMF :), which made it more difficult to give credit to companies, the beginning of the year was one of the biggest uncertainties regarding the economy. Anti-inflation target rhetoric, against the negative level set by the central bank, and hostile rhetoric about fiscal responsibility have spooked many investors. With the advancement of the framework that should replace spending caps and other agendas that have been discussed for years, such as tax reform, morale has improved.

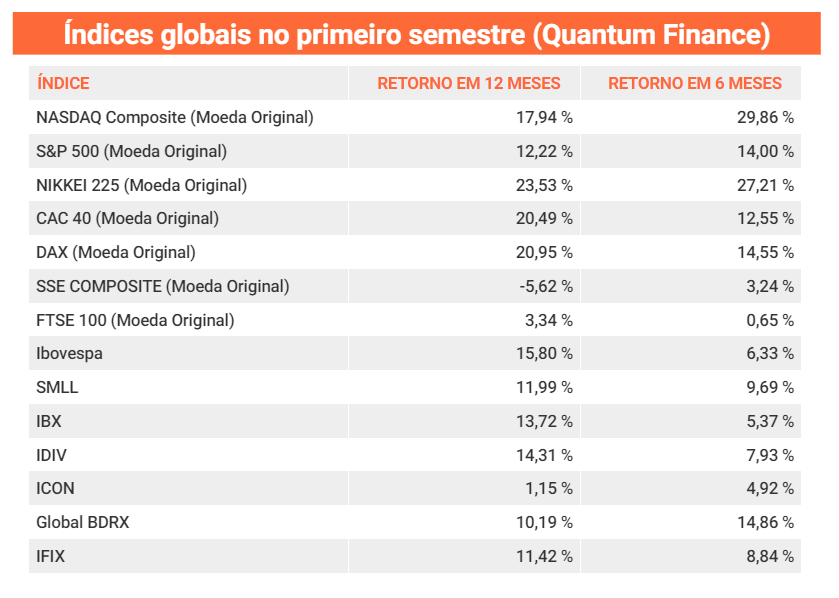

Thus, the Brazilian Stock Exchange was significantly lower than other global indices. The highlight, internationally, was the Nasdaq Composite Index, which posted its best first half in four decades, up nearly 30%. The second is the Standard & Poor’s Index, with about half the amount, in local currency.

Check out the index’s returns, according to data compiled by Quantum Finance through June 28.

Source: Quantum Finance

Jade Lima, an economist and specialist in variable income for the Business Improvement Plan, says volatility was high in both the domestic and foreign markets during the first six months of the year. In Brazil, analysts were cautious as to what economic policies the then-new government could adopt, especially with regard to public spending. With the development of the fiscal framework, the appreciation of real money and improvements in economic indicators, including growth in gross domestic product (GDP) and inflation, indicating that monetary policy may be eased soon, the Brazilian market has occupied a semester of rise, in your view. In addition to the increase in Ibovespa, small companies practically doubled their profits, Lima recalls.

Macroeconomic and microeconomic factors spurred the rise in sectors such as air transport, which recorded the highest increases, after suffering from lower demand in the pandemic. According to Lima, measures such as the Foa Brasil program and the devaluation of the dollar are among the drivers of these actions. In addition, the education and real estate sectors, which have a strong relationship with interest rates, had companies with expressive returns. “O was the growth one the most, up almost 40% in the first half,” he asserts.

The semester has been marked by its antagonistic moments, Joao Piccioni, an analyst at Empiricus Research agrees, starting from the perspective of monetary easing priced in later. Credit woes, the crisis in Americana, banks closing the taps to the corporate world, and poor results didn’t spur investors to take risks.

Since the US Bank Protection Scheme, appetite for variable income has been high, according to Piccione, with “a more positive reading in terms of emerging markets, Brazil, Mexico, India, as well as Japan. China has been on hold, leaving that story for the second half of the year.” With AI, when the big tech results came out and Microsoft (NASDAQ::) kept repeating the term, it generated a huge boost for the American stock exchange, and from there, there was even more willingness to look for new markets.”

The past few months have seen a change in the mood of the domestic market, with economic measures advancing and a “more skillful finance minister than Faria Lima thinks,” leading to an increase in confidence, according to the analyst. Looking at sectoral cuts, the first half was a flight from commodity stocks, leaving bets on China’s growth aside, and channeling resources into the domestic cycle. In the overseas market, the focus has been on major technology companies.

In addition, the Empiricus analyst recalls that several issues that had been abandoned have come back into focus, among them Estapar (BVMF :), as well as the entry of small businesses into the portfolios of important banks. Quality stocks, retail companies and the health care sector’s recovery are among the highlights, including Hapvida (BVMF 🙂 and Rede D’or. The analyst also lists BTG (BVMF:) and B3 (BVMF:) as positive recoveries. What we still haven’t seen in a clearer way is the consumer retail recovery. He adds that issues associated with e-commerce are still skating.

Guilherme Paolo, variable income operator Manchester Investimentos, recalls that the period was marked by strong returns from companies in the real estate sector, such as construction companies and shopping malls, as well as those in the financial sector, with banks such as Bradsco (BVMF:) rebounding. Insurance companies have risen a lot this year, as have companies in the electricity and sanitation sectors. The prospects for privatization have been positive, as have the auctions,” he quotes.

On the other hand, with the fall in commodity prices, companies in this sector have been penalized, he said. The commodity sector within Ibovespa represents nearly 40% of the sector, yet the Brazilian stock exchange has performed positively in the first six months.

What do you expect from the second half?

The Ibovespa index ended 2022 up 4.69%, which fell short of inflation and savings. But the outlook looks brighter for this year.

XP plans Ibovespa at 130K points at the end of the year, while Bank of America (NYSE: ) estimates 135K points in 2023. Guide goes further and forecasts 140K points.

Santander (BVMF :), in turn, sees Ibovespa at 140 thousand points, but in the middle of 2024, with the onset of a bull market in the second half of this year.

With rising interest rates in developed markets, a potential slowdown in the Chinese economy and a possible recession in the United States, all eyes are on emerging markets, especially Brazil and Mexico, in Jade Lima’s view.

“I think the wind is still favorable. This environment of interest rate cuts, largely due to economic data, decompresses political risks, particularly in fiscal matters and tax reform, which tends to increase clarity for economic clients. Among the catalysts, The return of foreign investors to Brazil will favor the Brazilian Stock Exchange, as well as institutional investors, notes the EIP specialist. Among the sectors that may be further boosted this second semester are retail, real estate, shopping malls, transportation, education, In addition to the assets of real estate funds.

However, as the winds are favorable, among the points of interest mentioned by Lima are some delays in the progress of reforms, a more risk-averse overseas segment, pressures on China’s activity, the impact on commodity firms, and a possible slump in overseas markets, which Stock exchanges can fluctuate.

The Manchester Investimentos specialist notes that stability or improvement in commodity prices could further benefit the Ibovespa index, but there are still many uncertainties about China’s growth potential. He advises that even in the face of loose monetary policy dynamics at the domestic level, it is important to pay attention to levels of influence and governance measures.

For the Empiricus analyst, investors are no longer worried about the companies’ results for the next six months. “It is enough for the company to survive. Many will buy forgotten issues on the stock exchange in the hope that the easing of pressure on interest rates will affect the results of next year, ”he believes, citing the retail sector, which is still under pressure. Among the most preferred companies are financial sector companies, such as Banks most closely associated with investment banking, such as Itaú (BVMF:), BTG, XP (BVMF:). In addition, Hapvida and Rede D’Or (BVMF:) may restructure balance sheets and attract investors again. He notes that “ Paper will be the retail sector, including Louisa’s own magazine.”

“Entrepreneur. Music enthusiast. Lifelong communicator. General coffee aficionado. Internet scholar.”