Original New Arrival Adidas Neo Label Men's T-shirts Short Sleeve Sportswear - Skateboarding T-shirts - AliExpress

ADIDAS NEO Full Sleeve Self Design Men Sweatshirt - Buy Black ADIDAS NEO Full Sleeve Self Design Men Sweatshirt Online at Best Prices in India | Flipkart.com | Winter outfits men, Mens

Amazon.com : adidas Men's Creator SS Athletic Tee T-Shirt Moisture Wick Drop Tail, Collegiate Navy, Small : Sports & Outdoors

ADIDAS NEO Embroidered Men Round Neck Blue T-Shirt - Buy ADIDAS NEO Embroidered Men Round Neck Blue T-Shirt Online at Best Prices in India | Flipkart.com

Amazon.com: adidas Originals mens Adicolor Neuclassics T-shirt T Shirt, Black, X-Small US : Clothing, Shoes & Jewelry

Looking for Round Neck Tshirt Store Online with International Courier? | Mens polo t shirts, Mens fashion casual outfits, Polo t shirts

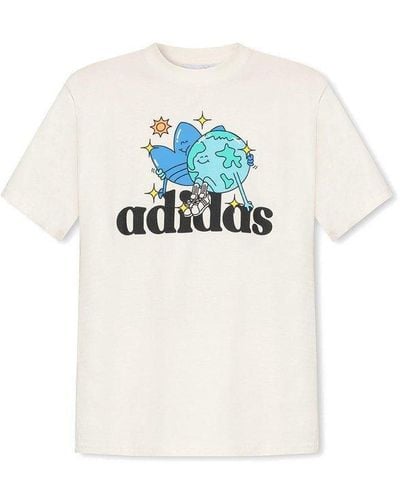

Original New Arrival Adidas NEO Label FAV TSHIRT Men's T shirts short sleeve Sportswear|Running T-Shirts| - AliExpress

ADIDAS NEO Solid Men Round Neck Black T-Shirt - Buy Black ADIDAS NEO Solid Men Round Neck Black T-Shirt Online at Best Prices in India | Flipkart.com