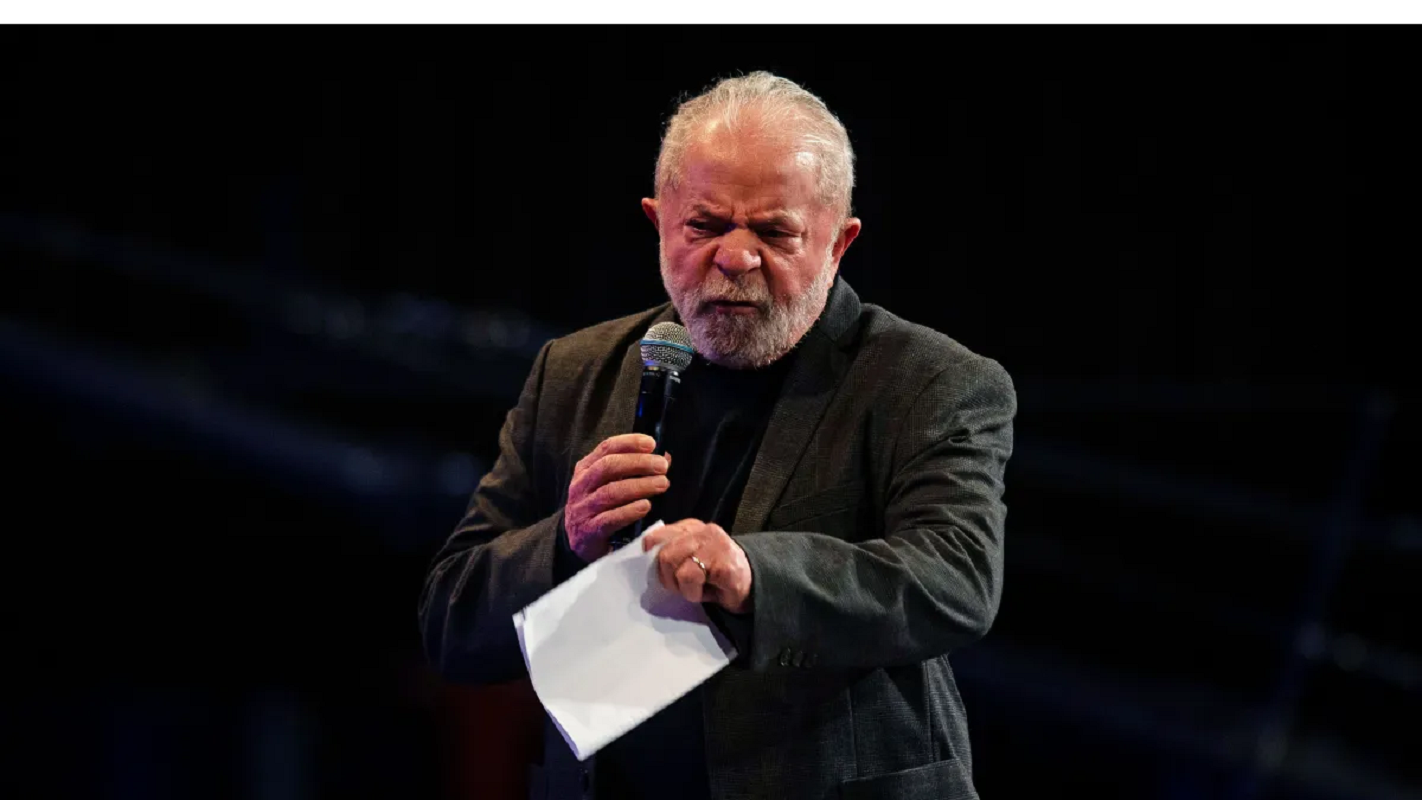

LULA hits the hammer and decides a big win for the Brazilians who are in debt

3 min read

President Lula, thinking of a way to make life easier for people in difficult financial situations, launched the Litígio Zero programme, which makes it easier for heavily indebted Brazilian citizens to get out of default. The main objective of the federal government is to promote national economic recovery.

According to Serasa, there are currently about 60 million Brazilians in debt. These people are in default of credit protection agencies, with their dirty names and negative status. Because of this, these citizens face a series of credit related problems on a daily basis.

With the help of the program, highly indebted individuals, businesses, and citizens will be able to fully fund their debts without having to pay interest and additional fees. According to the rules of Litígio Zero, the obligations of individuals and micro-entrepreneurs must reach 60 minimum wages.

However, small businesses can also get a discount of 40% to 50% to settle the amount owed. The program can help millions of Brazilians who have found themselves in debt due to the economic crisis that has devastated the country due to the COVID-19 pandemic, which has culminated in the closure of thousands of businesses.

A dirty name in the arena

In the beginning, it is very common to find friends and family with dirty names on the yard. The number of defaulted citizens is huge. A person with negative CPF can experience many personal and professional problems. Your project, for example, may suffer many consequences.

Highly indebted citizens may have difficulty obtaining credit, as financial institutions can easily obtain data on them on the Internet, through credit protection agencies such as Serasa and SPC. People who owe money are easy to spot in the field.

Citizens may not be able to make purchases in installments, given that businesses consider dealing with debtors a risk. Citizens are seen as people who cannot pay their bills. Even getting a credit card is difficult.

Likewise, citizens should take precautions and not fall into too much debt, better organize their budget and save whenever they can. It is necessary to update invoices and, if necessary, pay overdue amounts. So those in debt must quickly clear their names.

Zero Litigation Program

The Zero Litigation Government Program seeks to help defaulters across the country pay off their debts. In some cases, it is possible for up to 100% of your debt to be forgiven. To register, citizens must go to the website of the Virtual Service Center of tax authority. The deadline for registration is March 31.

In short, debt renegotiation through the government’s Litigation Zero program allows taxpayers to pay off debts that are included in delinquent debts with the union. It guarantees a large number of benefits to citizens, such as reduced income, and discounts on the total amount for late payment.

The program, in addition to helping settle the debts of Brazilian debtors, also opens the door for the government to recover the money. It is expected to recoup about R$25 billion in 2023 alone, and the total debt with the union currently stands at R$1 trillion.

In this way, the Zero Litigation Program has a wide range, throughout the national territory, regarding the type of debt with the Federal Revenue Service. In short, people and companies will be able to negotiate their debts at the Federal Revenue Office (DRJ), or at the Administrative Board of Tax Appeals (Carf).

Conclusion

Litigation Zero offers debtors the possibility of repaying their debts in installments of up to 12 installments, with discounts on interest, in addition to canceling the fine, clearing their names and opening up greater possibilities for obtaining credit. In this way, the program seeks to end the rift between individuals, businesses, and the government.

In conclusion, the official name is Tax Litigation Reduction Program. It covers all tax collection, opening a series of income tax negotiations, CSLL, PIS, Cofins and IPI. It is worth noting that there are different rules for individuals and small and medium-sized companies throughout the national territory.

“Entrepreneur. Music enthusiast. Lifelong communicator. General coffee aficionado. Internet scholar.”