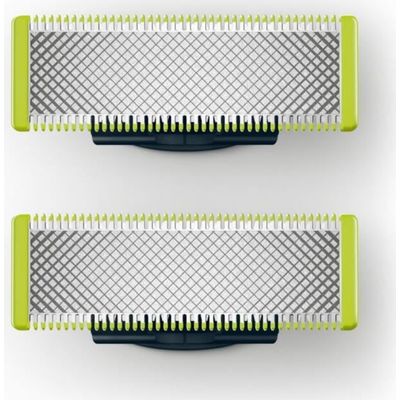

Aparat hibrid de barbierit si tuns barba PHILIPS OneBlade Pro QP6505/21, acumulator, autonomie 60 min,

Aparat hibrid de barbierit si tuns barba PHILIPS OneBlade Pro QP6505/21, acumulator, autonomie 60 min,

Altex Mioveni - ✴ OFERTA ZILEI !!! ✴ Perfecționează-ți stilul în câteva secunde. Stoc limitat ! Altex Mioveni #altexmioveni | Facebook

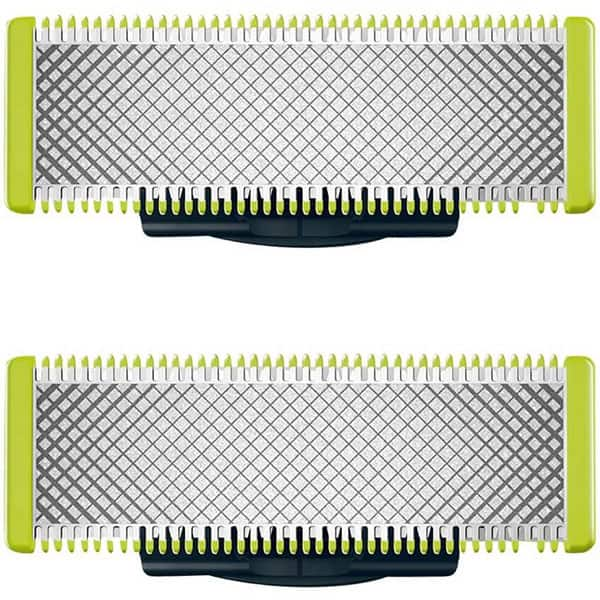

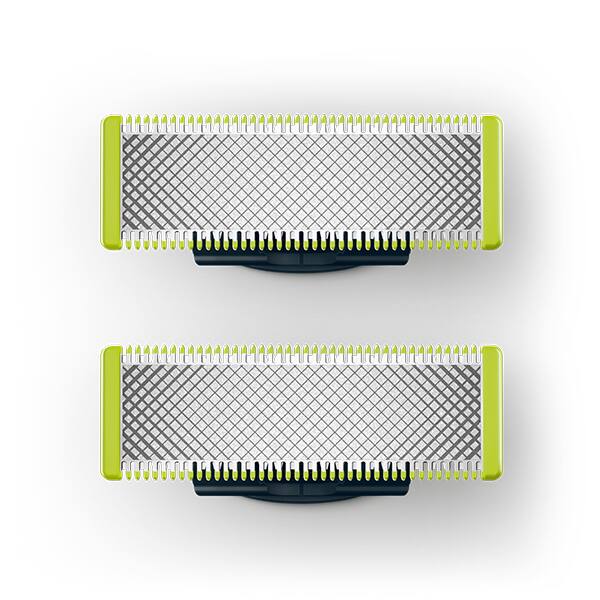

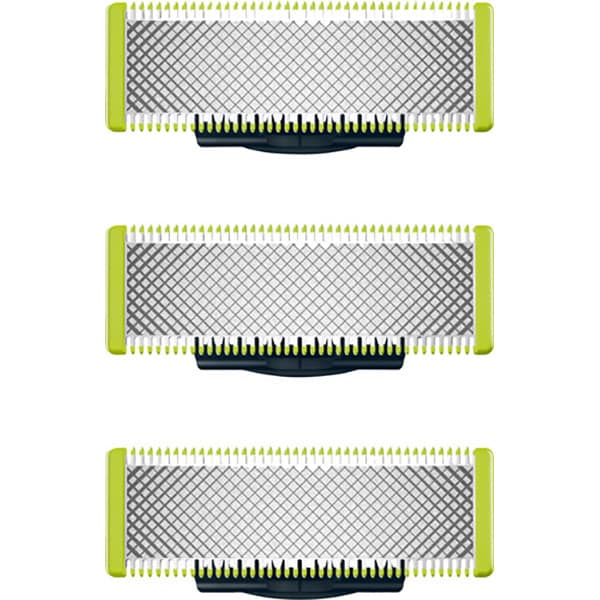

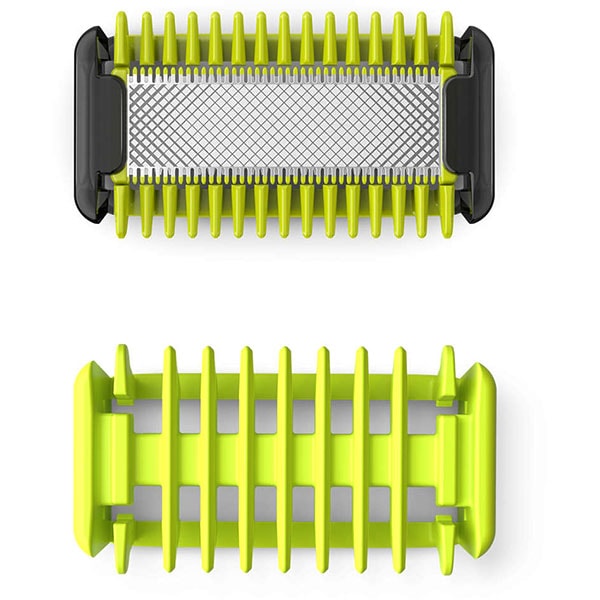

Philips OneBlade QP2520/20 Aparat hibrid de barbierit si tuns barba, 3 piepteni, Acumulatori, Negru/Verde - eMAG.ro

Aparat hibrid de barbierit si tuns barba Philips OneBlade Pro QP6520/20, acumulator, autonomie 90 min, Pieptene cu 14 lungimi, Afisaj digital, argintiu