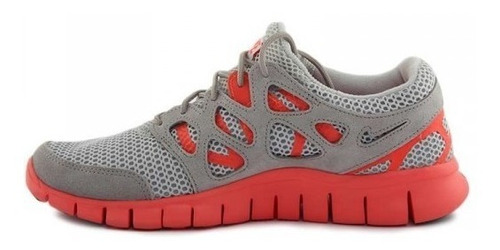

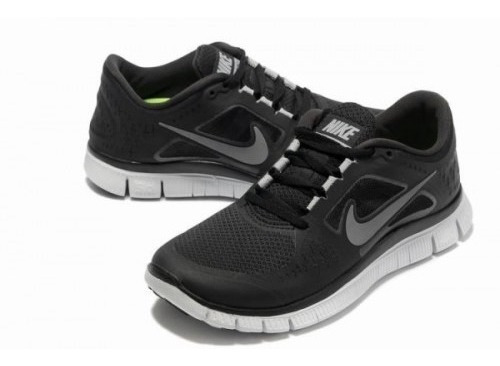

Zapatillas Nike Free. ¿Cuál es cuál? | Blog de Running, Fitness, Sneakers y Estilo de Vida | Runnics

Los que MÁS saben de zapatillas de running de Nike y los que MEJOR corren juran que estas nuevas zapas son la bomba

Nike Free RN 2018 Zapatillas de running - Hombre | Zapatos nike hombre, Zapatos nike mujer, Zapatos deportivos nike