adidas originals for beams and black pants 2017 GY7658 Release Date - SBD - adidas terrex agravic gtx s80574 sale 2016 shoes

adidas Originals Adicolor Classics Firebird Primeblue Track Pants H09032 - adidas n 5923 ash pearl blue unripe dress shoes - Best shoes JofemarShops

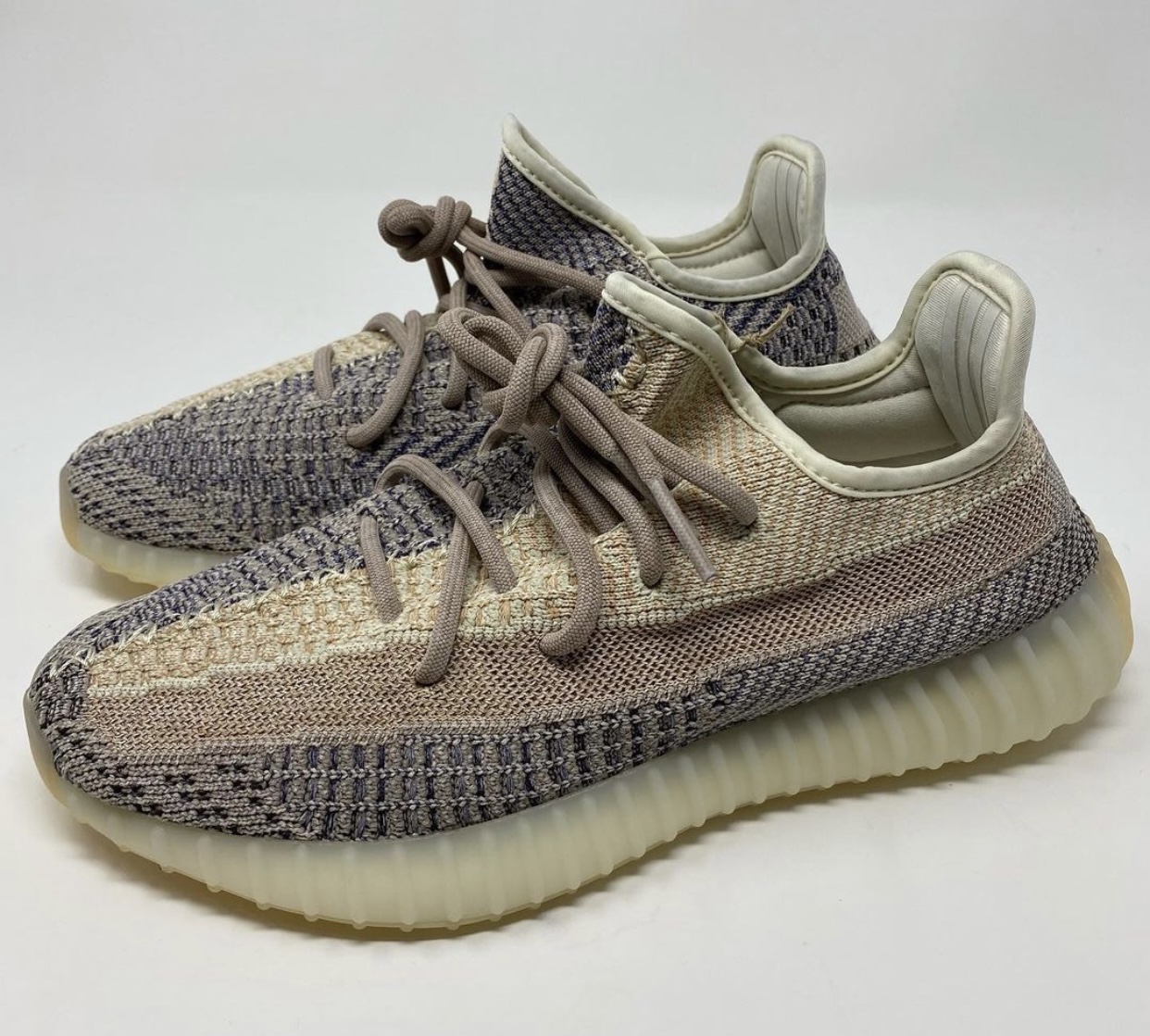

Grailify - adidas originals joggers boys pants for women - This Is What the adidas Yeezy Boost 350 V2 "Ash Pearl" Looks Like

active adidas ultra boost women ash pearl IE - adidas Originals Mens Adventure Field Pants - Grey | adidas b42199 women black sneakers sale

Bolivia-embajadaShops | Bolivia-embajadaShops DESIGN co - adidas alphabounce ash pearl green granite - ord knitted jogger with tie waist detail in khaki

Bolivia-embajadaShops - adidas ultra boost ash pearl linen fabric sale - shirt in blue | palace adidas track pants size chart women shoes NSE Box back print long sleeve t