Αποκλειστική συνέντευξη με τις Ελληνίδες Designers παπουτσιών του “Once Upon A Shoe”! - Δημιουργίες βγαλμένες από παραμύθι! - Made in Greece

Made in Greece τα Ria Labrinoudi: Γόβες, μποτάκια, πέδιλα που συνδυάζουν κομψότητα με άνεση από την ταλαντούχα σχεδιάστρια - Made in Greece

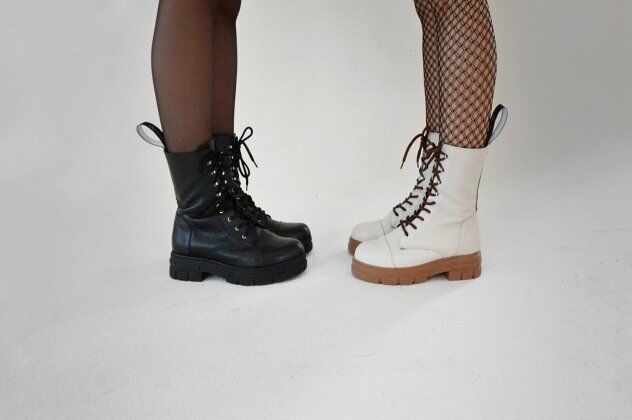

Made in Greece τα De.bour και η δημιουργός : Η Ντέπυ Μπουρνάζου φτιάχνει παπούτσια όνειρο - Δείτε τη νέα συλλογή (φωτό) | eirinika.gr

Ντέπυ Μπουρνάζου: «Με ιντριγκάρει ότι πολλές γυναίκες αλλά και άντρες έχουν τα παπούτσια ως φετίχ» | Gossip-tv.gr

Η απίθανη ιστορία του Στρατή Νάκη: Μυτιλήνη- Νέα Υόρκη, με μια βαλίτσα γεμάτη custom drip. - Εφημερίδα Πολιτικά

Made in Greece τα De.bour και η δημιουργός τους Ντέπυ Μπουρνάζου - Χειροποίητα παπούτσια με ελληνική υπογραφή! (φωτό) | eirinika.gr

Made in Greece τα εκπληκτικά παπούτσια Di Gaia - Σανδάλια, slides, εσπαντρίγιες και hi-heeled πέδιλα (φωτό) - Made in Greece

Made in Greece τα παπούτσια Haralas: Κοσμοπολίτικο ύφος, διαχρονική φινέτσα, ανατρεπτικά χρώματα στη νέα συλλογή (φωτό) - Made in Greece

Η εκδήλωση-διαγωνισμός για τις λαζαρίνες - Απονομή βραβείων στις νικήτριες του διαγωνισμού | www.fatsimare.gr