Americanas (AMER3) Files for Bankruptcy: What Happens to the Company’s Stock on the Stock Exchange?

4 min read

Americana (Amer 3) Judicial recovery announced (RJ) is in the middle of the trading session this Thursday (19), a few hours later To mention that it will be imminent. The request came a week after the company discovered “accounting discrepancies” worth R$20 billion.

The company’s debt adds up to R$43 billion and includes financial creditors, labor and suppliers and is the fourth largest case ever registered in the country.

The company said Thursday that it has a cash position of R$800 million, a “significant part” of which was “unjustifiably unavailable to transact yesterday,” after BTG Pactual (BPAC11) Get it in court The right to seize R$1.2 billion in the custody of the Bank.

The situation is very different from the one presented by the former CEO of the retailer Sergio Real, who stated in a conference with the market last week that the company has a cash position of R$7.8 billion, which leaves the company in a comfortable position to meet current obligations and carry out the operation while negotiating with banks, in addition to continuing investigations into possible fraud. However, with no cash and few assets, it became an RJ request seen only as a “matter of time”with order confirmation.

With the request for judicial recovery now filed, what will happen to the company and its shares?

Immediately after the order, the first step is to suspend the stock trading. The duration of this suspension depends on the judge in the case and the stock exchange. A survey of the company’s circumstances and what was submitted in the application will be done in order to contact the market. After the period set by the judge, the shares are traded again.

Continue after the announcement

Moreover, once the redemption request is approved, the company gets a period of 180 days (protection period) in which all its debt obligations are suspended.

Stocks must leave Ibovespa and all other indices, since according to the B3 methodology, companies that are subject to judicial recovery are not eligible to be part of any index.

“Therefore, Americana must be removed from the indications in which it participates if a judicial redemption is sanctioned, and such withdrawal usually takes place the day after the declaration,” XP highlights.

Below is a table of indices that Americana is a part of:

in previous report XP had already indicated four major ramifications for Americana’s work in the face of judicial realignment.

Continue after the announcement

The company will be in this delicate state for a long time, at least three years, the house estimates. It is estimated that the exit from Ibovespa could adversely affect the liquidity of the shares.

In this process, “housekeeping” or rebalancing of the capital structure can occur through sale of assets, renegotiation of debt, conversion of debt into equity and capital increase. However, the dissolution of the company is also not excluded.

In the midst of all this, a lot of twists in the tabloids are to be expected. “Stocks tend to suffer during bankruptcy proceedings, because the proceedings are focused on creditors and are generally dilutive for shareholders,” analysts Daniela Egger, Gustavo Sendai and Thiago Suedt wrote.

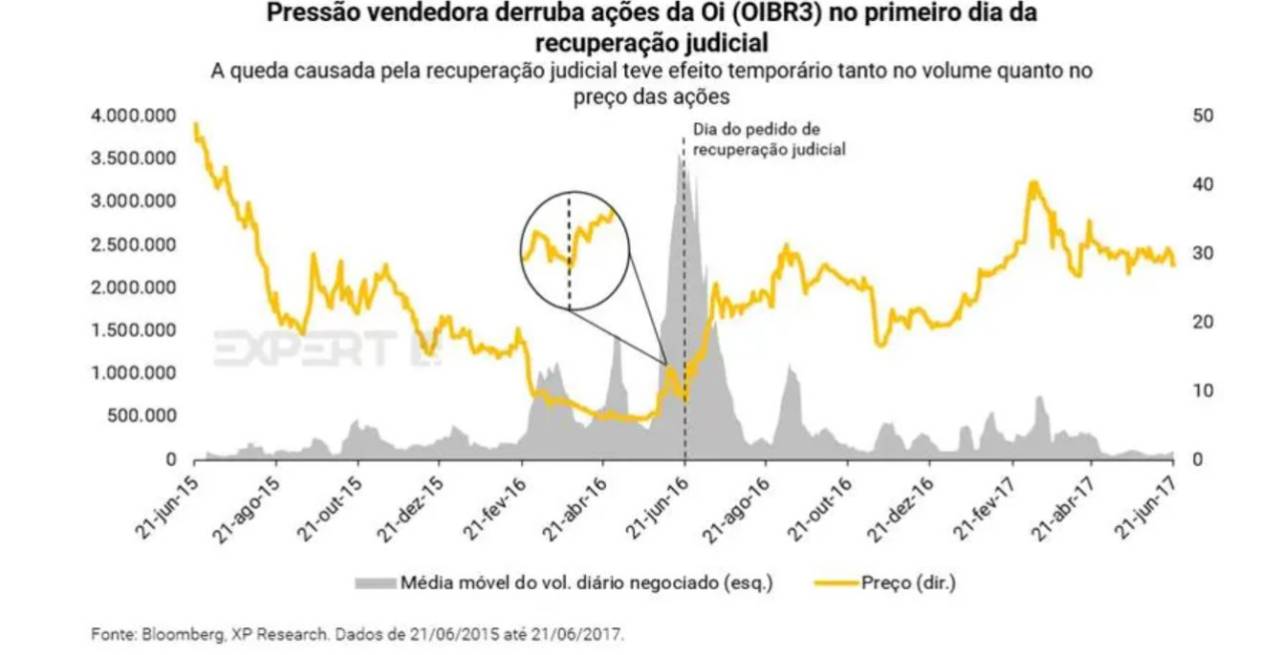

In the latest report, XP also highlighted what could happen in the hearing after a request for judicial recovery, with a sharp decline in assets, citing the case of Oi (OIBR3;OIBR4). The company declared bankruptcy on June 20, 2016, and the next day, blue chips closed down more than 18%, after crashing more than 30% at a session low on the 21st. Recovery in December last year, which led to a Stocks rose in the post-announcement session.

XP maintains the “Under Analysis” recommendation for Americana, in line with Recommendation on review of assets by several analysis houses shortly after the billionaire’s accounting discrepancies were announced.

Also speaking about the impact on company operations, Morgan Stanley highlighted that in a judicial recovery, companies can continue to operate, while entering a process that will eventually end with a financial restructuring.

Thus, Aldar analysts believe that a judicial recovery could accelerate the pace of Americana’s waiver of participation in national e-commerce (about 15%, according to a 2022 forecast), the bank notes.

Morgan Stanley sees the free market (Millie 34) is likely to be the company with the largest market share from Americanas, while Luiza Magazine (MGLU3) and across (VIIA3) also Show up among potential recipients.

Check out the following steps for Americanas in the case of judicial recovery, as explained by XP:

- Presentation of the recovery plan: The company has up to 60 days to submit the first version of the restructuring plan, with the main actions to be taken to balance the capital structure, generally focused on three main pillars:

(i) Liability management: It can be done through debt negotiation (reductions or term extensions) and debt-to-equity conversion;

Continue after the announcement

(2) Capital infusion: XP estimates that between R$10 billion and R$20 billion will be necessary;

(3) Divestment from assets: XP analysts believe that Hortifruti Natural da Terra, Grupo Uni.co (Puket and Imaginarium), and Joint Vem Conveniência could be potential candidates.

- Creditors meeting: The company has up to 150 days to call a meeting of creditors to approve the plan;

- Approval of the restructuring plan: The law says the protection period is sufficient for a plan to be approved, although it can be extended for another 180 days.

Learn how to invest in a CDB that brings up to twice the savings with daily liquidity and protection from the Credit Guarantee Fund (partnership with XP)

Related

“Entrepreneur. Music enthusiast. Lifelong communicator. General coffee aficionado. Internet scholar.”