Open Banking: Data sharing between banks begins today that can facilitate credit. understand

4 min read

Brazil – Clients of major banks and fintech companies will begin to notice the effects of so-called open banking in their daily lives.

Starting today, people will be able to choose whether to share their registration data with which financial institution, as well as information about transactions in their account and credit history.

The idea is that with this information on hand, financial institutions can offer customized and cheaper products. Another change can be felt when opening an account with a bank or fintech. With the sharing of registration data, the process should be simpler and faster.

The promise is that this data sharing will stimulate competition, which should lead to lower fees charged by banks, including interest.

For example, if a fintech company can access a 15-year credit history of a large bank client, it can offer that person cheaper and more personalized products.

In addition, in the future, the company can launch a complex of credit offers, and using the customer’s credit history, you can offer offers that are cheaper and with better conditions.

Have you seen this? BC wants to launch ‘Pix card’ by the end of the year, with payment approx

Open banking enhances competitiveness, you can put in place new institutions that lead to lower onerous costs of operations compared to traditional ones. In the end, whoever wins this is the consumer – says Luciana Simويسes Rebelo Horta, an attorney at Baptista Luz Advogados.

The first stage was supposed to start on July 15, but Postponed by Central Bank (BC) At the request of financial institutions that would like more time to set up their systems. In the first stage, enterprises have opened basic information, such as service channels and services provided.

BC confirms that no data sharing will be made without prior permission. The duration of participation is limited to 12 months and the customer can revoke it at any time. When making a transaction, banks and fintech companies must describe all the information that will be shared.

more time: Banks ask BC to postpone implementation of Pix Saque, which allows cash withdrawals in stores

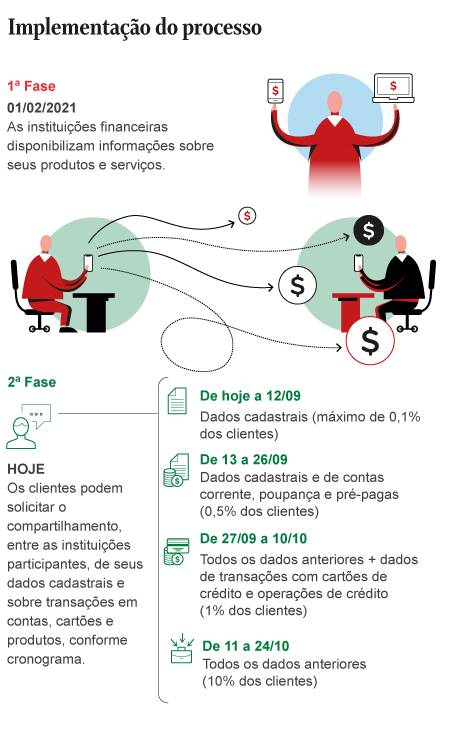

in four steps

Attorney Guilherme Guimarães, co-founder of Guilherme Guimarães Advogados, states that the client should assess whether financial institutions provide clear information about the use of data:

– The customer must be aware of the security measures that financial institutions will use to protect his data, especially in the case of transactions with partners and correspondents.

The second phase will be implemented in four phases until October 24. But the third phase of open banking is scheduled to start on August 30.

diversity:The stock market individual investor grew 43% in the first half

Here, you can make a payment using one organization’s account balance from another organization’s app.

The second phase will be implemented in a staggered manner in four cycles. In the first, which runs from Friday to September 12, 0.1% of the enterprise customer base will have access to APIs (application programming interfaces) that will allow creation, consultation and opt-out of information sharing.

During this time, open banking services will be open from 8:00 am to 6:00 pm, seven days a week.

In the second cycle, from September 13 to 26, the sharing will be for information related to demand deposit accounts, savings accounts and prepaid accounts. This stage will have a limit of 0.5% of the customer base and will also operate from 8:00 AM to 6:00 PM on weekdays.

On the ESG agenda: Exchange tightens rules for companies to abide by the sustainability index

From September 27 to October 10, customers will be able to share information about their cards and credit operations. The limit will be 1% of the base, business hours will be 8:00 am to 6:00 pm from Monday to Wednesday, 24 hours a day on Thursday and Friday.

In the fourth and final cycle, which runs from October 11-24, all information from previous cycles can be shared 24 hours a day, seven days a week. The limit will be 10% of the customer base.

Phase 3 is scheduled to begin on August 30. One of the new features will be the ability to initiate a payment with an organization’s account balance from another organization’s app.

For example, if a customer only has a balance in a traditional bank account and wants to use a fintech app to pay a bank voucher with that balance, it will be possible.

Fight for customers: The independent agent market is entering a new phase and the dispute is now for millionaires

In stage 4, open banking expands beyond banks, and data on foreign exchange operations, investments, insurance, open pension funds and payroll accounts can also be shared with various institutions. The start date is set for December 15th.

“Entrepreneur. Music enthusiast. Lifelong communicator. General coffee aficionado. Internet scholar.”