Petrobras (PETR4) Releases Balance Sheet On 5th Of This Month With Cautious Dividend Policy By Investing.com

4 min read

Investing.com – Oil company Petrobras (BVMF 🙂 released its results Thursday the 11th, with investors interested in the investment plan and dividend policy updates, which have been criticized by the government, the major shareholder and the company’s watchdog. The results conference of the state company is scheduled for May 12, Friday, at 10:30 am (Brasilia time). This Wednesday, the 10th, preferred stock Petrobras closed the trading session down by 0.24%, at R$24.53.

In its production and sales report for the January-March period, released May 3, Petrobras reported that it had average oil, natural gas liquids and natural gas production of 2.68 million barrels of oil, up 1.1% from the total recorded in the fourth quarter. The increase occurred due to the onset of P-71 intensification, in the Itapu field, in the pre-salt Santos Basin, the entry of 8 new wells in the Campos Basin and efficiency gains, according to the document.

Petrobras credit: dividends and capital expenditures should be the focus

The current compensation policy states that Petrobras can distribute 60% of its operating cash flow less capital expenditures. At the end of April, the shareholders agreed, in a meeting, to pay an additional dividend of R$35.8 billion announced with the results of the fourth quarter of last year.

Also at a rally, the shareholders elected the new board of directors under the government of PT Luiz Inácio Lula da Silva. With Lula’s campaign promises on fuel, also championed by the new CEO, Jean-Paul Pratis, investors are cautious about how the balance sheet should handle the company’s dividend policy.

Since the election campaign, Lula has been critical of pricing policy and dividend strategy, in the view of the president. The concept of the Batista is that distribution should be reduced, to make resources available for research and development.

“Petrobras, which in our time was a development company for this country, has now become a company for the export of crude oil. This is not why we discovered a pre-salt layer,” Lula said in March this year.

For Gustavo Cruz, chief strategist at RB Investimentos and Mateus Haag, analyst at Guide Investimentos, these two points will be key to analyzing the balance sheet. Cruz stresses that the government’s political desire is to increase investments, whether in renewable energy, or building platforms, among other possible initiatives. “The government has been suffering defeats in Congress, so we think the intervention in state-owned enterprises should be greater,” notes the strategist, who believes in cutting dividend payments to the necessary minimum.

Mateus Haag, an analyst at Guide Investimentos, considers that the market expects to maintain the distribution policy, but he is not optimistic about this either. “If Petrobras maintains the distribution strategy, the payout will be very high and the stock should react well. But we know this has to change. President Lula and the Labor Party are against dividends, and Lula has already commented that he does not agree with this policy and we know that the chance of change is high Very at some point, but we don’t know for sure if that will happen in that first quarter.”

What do you expect from Petrobras (PETR4) balance sheet?

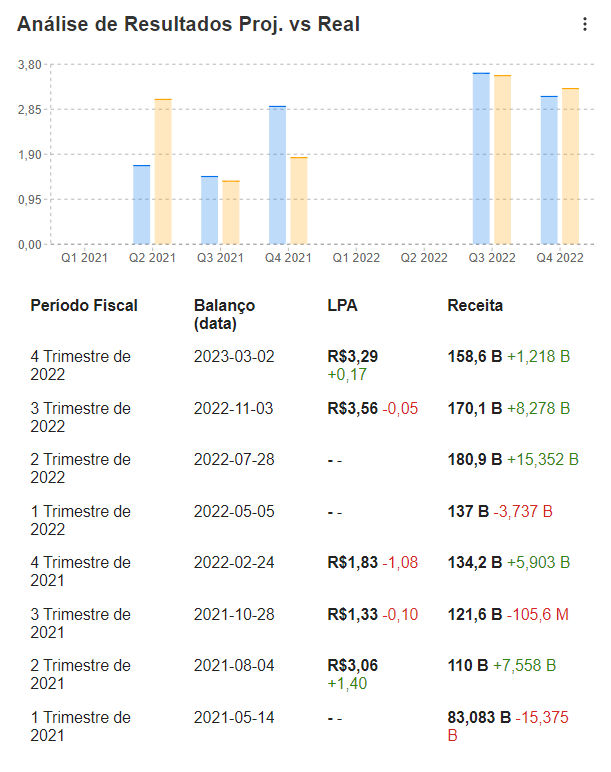

The average earnings per share (EPS) projected by analysts compiled by InvestingPRO indicates a value of R$2.06 per share for the first three months of this year, while revenue is estimated at R$135.3 billion. As shown in the image below, a study of the history of Petrobras’ financial indicators indicates the possibility of a decrease in this indicator, compared to the two immediately preceding quarters.

While EPS for the October-December period was R$3.29, revenue was R$158.6 billion. Revenue jumped from R$137 billion in the first quarter of last year to R$180.9 billion in the second quarter, with a drop to R$170.1 billion in the third quarter of 2022.

Source: InvestingPRO

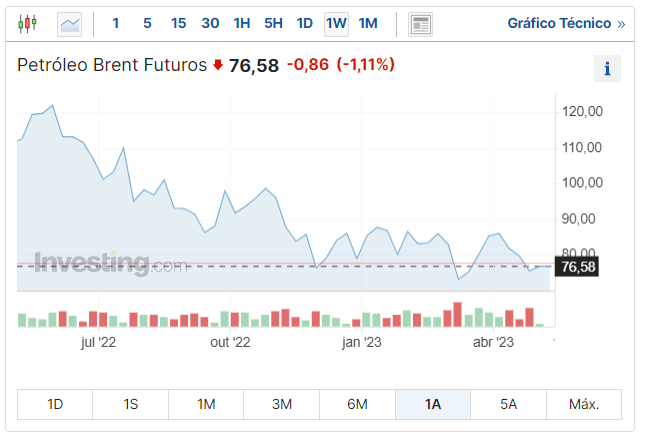

Revenues were driven from the second quarter of last year by the rise in the price of a barrel of oil, which led to record financial indicators, which benefited from the distribution of dividends to shareholders. However, as commodity prices were going through the process of adjustment, analysts consulted before Investing.com Brazil We think there will be an impact on the balance sheet.

“Many managers have filled Petrobras in the portfolio because the policy has brought very strong dividends. The price of a barrel of oil has crossed $100, which has boosted Petrobras and other oil companies around the world. This quarter, the data will be weaker, both for the company and for others, with Effects on revenue and earnings, as prices in the quarter were around $80 per barrel, and that’s the main product, Cruz assessed.

“Petrobras has already announced the resumption of production in some fields in the Bahia Terra group and this may have led to an increase in the company’s capital expenditures,” Haag adds.

Source: Investing.com

What is a fair price for Petrobras?

However, according to data cited by the InvestingPRO platform, the average aggregated analyst estimate indicates a fair price for preferred shares of R$38.10, a potential increase of 54.8%.

Moreover, for ADRs traded in the United States (USA), the fair price is expected to be $16.49, an increase of 48%.

Source: InvestingPRO

How does it compare with its peers?

With InvestingPRO’s comparison tool, it is possible to compare Petrobras shares with other oil companies in the country. The tool shows that the company’s estimation potential is greater compared to its peers, but the analysts consulted them Investing.com Brazil Remember that uncertainties about the company’s dividend and investment policies may change the understanding of the oil company’s risks under the new government.

Source: InvestingPRO

notice: This content has been written for informational purposes only and does not constitute any solicitation, offer, investment advice or recommendation, and is not intended to encourage the purchase of assets in any way. Detailed information is based on InvestingPRO’s tool and technical notes from analysts consulted by the press team.

“Entrepreneur. Music enthusiast. Lifelong communicator. General coffee aficionado. Internet scholar.”