What are the best mutual funds for 2023?

5 min read

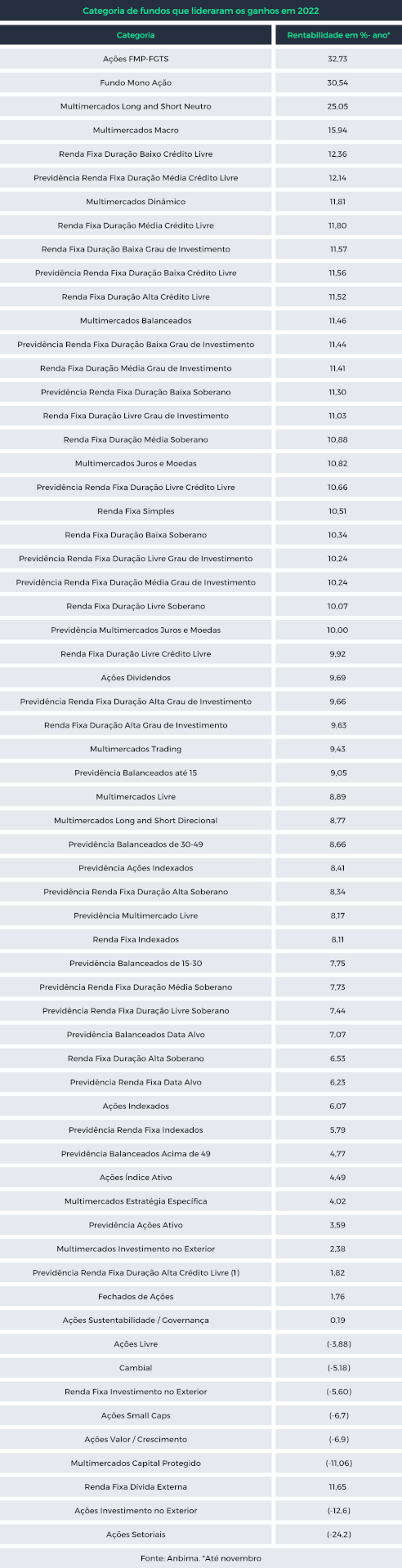

In the scenario of a rising Selic rate in Brazil, uncertainties about fiscal policy and the still uncertain context in the international market, amid rising interest rates and the risk of recession in the United States and Europe, Multi-market fixed income funds and private credit Analysts view them as the products that will be able to generate the best returns in 2023.

“We will have a volatile environment that will provide good opportunities for these funds, which play an important role in diversifying investors’ portfolios,” says Julio Ferreira, director of allocation at Julius Baer Family Office.

Despite the good return of many hedge funds in 2022, It was the category that suffered the most recoveriesrecording a net outflow of R$83.7 billion as of November.

Which hedge funds to invest in?

With the Selic rate at 13.75%, many investors have ended up moving provisions to fixed income securities with the goal of seeking gains closer to 100% of the CDI.

However, the macro-market multi-fund category, which includes well-known portfolios in the market, such as green background a raptorfrom SPX Capital, and ASA hedgefrom Asa Investments, and Vinland Macrofrom Vinland Capital, handily beat CDI, accumulating a return of 15.94% in the year, through November, against a variance of 11.12% from standard🇧🇷

said Bruno Merola, fund analyst at Beta Research.

“In 2023, multi-market managers should take less risks, because they don’t see such a clear opportunity for gains abroad,” he says.

How much do you invest in multiple markets?

The Empiricus analyst recommends 20% to 30% in multi-market funds for a moderate investor.

Abroad, the Federal Reserve (the Federal Reserve and the US Central Bank) started Slowdown in the process of raising interest ratesHowever, it is not yet clear how long the base rate must remain elevated to bring inflation back to the 2% target.

There is also a lot of uncertainty about the severity of the economic recession that should occur in the United States and Europe and its impact on corporate profits, which should determine the behavior of the American stock market.

In Brazil, the uncertainty about what isNew tax anchor And bring more caution to bets on a cut in the Selic rate in 2023.

Nord Research partner and fund analyst Luiz Felippo notes that multi-market funds have a more flexible allocation mandate and are not required to have exposure to certain asset classes.

These products can allocate assets in different markets, not just in Brazil, which allows them to better navigate the expected scenario for the coming year.

“In a volatile country like Brazil, the way to do well is to have a diversified portfolio across asset classes and managers,” says Filippo.

However, it is necessary to separate the wheat from the chaff and look for good managers. An option for investors who want to invest in popular closed-end investment funds or targeting only qualified investors (with investments over R$1 million) is to allocate funds invested in popular portfolios.

The Nord Melhores Fundos portfolio, for example, combines five multiple markets radar, from Genoa Capital, which was closed for financing; a vertex Absolute investment Zeta, by Kapitalo, which is targeted only to qualified investors; a atlasby Kinea Investimentos; it’s the legacy bby Legacy Capital.

All of these funds comfortably beat the CDI in 2022.

Nord’s Fund of Funds management fee is 0.50% per annum and the total portfolio cost is 2.03%. “At Nord, we return the discount fee (the commission for those offering assets) back to the fund,” says Filippou.

Higher interest rates favor credit funds

For the investor who wants to get a higher return on CDI without managing stock risk, the Free trust funds It could be a good choice.

In 2022, the category has accumulated an average gain of 12.36% through November, above the 11.12% CDI variance.

Partner at Nexgen Capital, Luiz Carlos Corrêa, sees demand still strong for products in this category in 2023. “These are attractive funds, which have been able to generate returns of 120% to 130% on CDI,” he says.

Fixed income funds that buy private credit securities benefit from higher interest rates and mushroom (premium) received by investors in debt securities issued by projects and companies.

In 2022, we haven’t seen a significant uptick in Margins, which, on average, is 1.60 percentage points above CDI; But if the risk of default increases, then this mushroom It has to go up,” confirms Merola.

The Empiricus analyst sees a scenario of an increase in companies with credit problems, which should lead managers to focus on less risky companies and diversify the portfolio among several issuers.

In this sense, Merola points out that it is important to be aware of the liquidity risks of these funds. Portfolios with redemption terms of less than five days may experience liquidity problems, because if there is an increase in redemption requests, the manager will be obligated to sell the shares in the portfolio at any price, penalizing the share value, as happened in 2020 during the pandemic.

Among the fixed income funds that performed well in 2022, Mérola highlights SPX Seahawk, It is managed by SPX Capital, which gained 13.63% in 2022, through Dec. 21, above CDI, which has accumulated 11.97% in the period.

The Empiricus analyst recommends allocating 15% to 20% in trust funds to a moderate investor, not exceeding a 5% concentration of the portfolio in each manager.

Maintaining high interest rates postpones the returns of equity funds

with the letter jThe Brazilian uros is expected to remain in the double digits Next year, Merola believes it will take some time for investors to return to equity funds.

This should only happen, according to the Empiricus analyst, when the stock market starts to rally and the central bank starts cutting interest rates. “But even so, I don’t think Cilic’s drop to 11% will be enough to get people back on the stock exchange.”

For investors between the ages of two and four, Corrêa, of Nexgen, thinks equity funds are at an exciting level to get into. He notes that “the scenario will be very difficult for the stock exchange in the first half of 2023.”

For those who already have investments in these funds, this is not the time to walk away, Koureh warns. “The bailouts for equity funds should continue to flow until the government at least indicates what it will do.”

An Empiricus analyst recommends a 15% stake in the stock exchange for a moderate investor.

Is it worth investing abroad?

Investing in international funds is a good way, according to managers, to diversify Brazil’s risks.

Although funds from well-known managers such as Pimco Income, All Weather, from Ray Dalio’s Brigdewater, and Oaktree Global Credit, from manager Howard Marks, have struggled this year, these portfolios have a good track record of performance. And they can be interesting investment options, because they are available to investors in Brazil on some platforms, says Correia.

If the goal is to diversify the portfolio, it makes sense to allocate hedge funds International markets that are exposed to foreign exchange risk.

Empiricus recommends allocating 20% to 25% of the portfolio to international assets for investors of moderate profile.

⇨ Do you want to do better in the stock market? the Investment guide He will guide you!

“Entrepreneur. Music enthusiast. Lifelong communicator. General coffee aficionado. Internet scholar.”