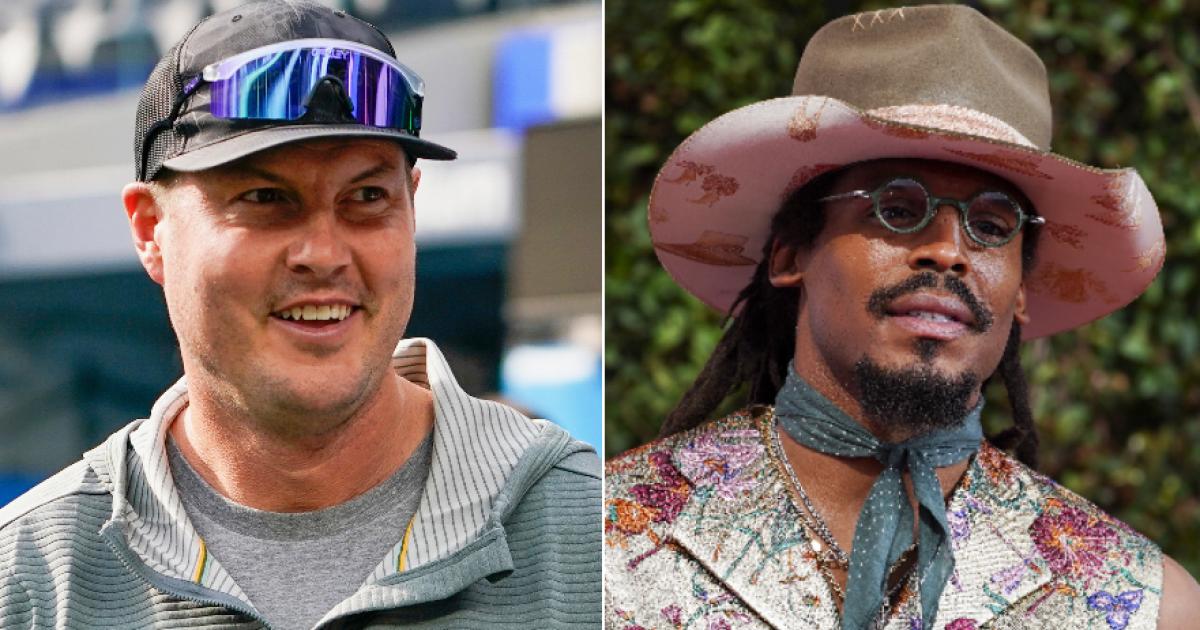

Former NFL MVP Came Newton, Age 36, Sadness 36, The terror of India called the Indianapolis Cots who took the past rivers and even reached him. Cam nayton on the Colts signed Philip Hawaii Click here to listen to this...

Today's health news includes the year of reproductive health for reproductive researchers, growth in the treatment of muscular dystrophy, and more. Get your daily dose of health and medicine from STAT's free newspaper on the first day of the week.Register...

For nearly 60 years, doctors have routinely given vitamin K to newborns to prevent uncontrolled bleeding. Vaccines aren't the only near-miraculous medical intervention that some Americans are turning away from.A new study released today shows that more and more children...

GM Brian Cashman provides updates on the Yankees heading into the winter meetings.Read more at MLB Trade Rumors. Yankees general manager Brian Cashman spoke to reporters on Sunday, offering updates on some key free agents and discussing roster plans for...

Creatine is taken by many people who hope to get stronger, improve their workouts and promote muscle growth Why young people should avoid this widely used sports supplement Many people are creating confines in hopes of getting bigger, improving athletic...

A new study shows that the shingles vaccine may protect against dementia.Here are the details. Diseases of Spop can be reduced, prevent Deteria Orute New research suggests that the shingles vaccine may reduce the likelihood of developing dementia and slow...

Fruits are an important source of vitamins, minerals and antioxidants. 6 Fruits to Eat More Of for Better Kidney Health, Recommended by Health Experts These expert-backed fruit picks make it delicious and easy to support your hardworking kidneys. By Joy...

Two weeks ago I went to a round table in London where gnount (hearing aids under the DanoLogic and Beltone brands, Danotechnics and Belenon brands) was talking about a new technology called Aurakest, which allows hearing users to watch live...

The Steelers must decide whether to pick up the 2027 option on coach Mike Tomlin's contract on March 1, sources told ESPN. The Pittsburgh Steelers won't fire coach Mike Tomlin, but they will have an important decision to make early...

You can still get Cyber Monday deals after the sale, including the lowest prices on the Apple Watch Series 11. Apple's CyberMonac runs Monday, and you can still find discounts on Apple Watches and AirPods 4 Cyber Monday is over,...